Retirement organizing could be a challenging project, but it’s vital to safe your future economically. Among the best approaches to achieve this is by using treasured materials such as silver or gold. This not simply gives a hedge against rising cost of living but also diversifies your investment collection. With all the existing global financial doubt, a lot more investors are opting for a gold ira transfer so as to safe their retirement financial savings. With this guideline, we’ll talk about everything you need to learn about a Gold ira rollover and just how it may help you accomplish your pension objectives.

Just what is a Gold ira rollover?

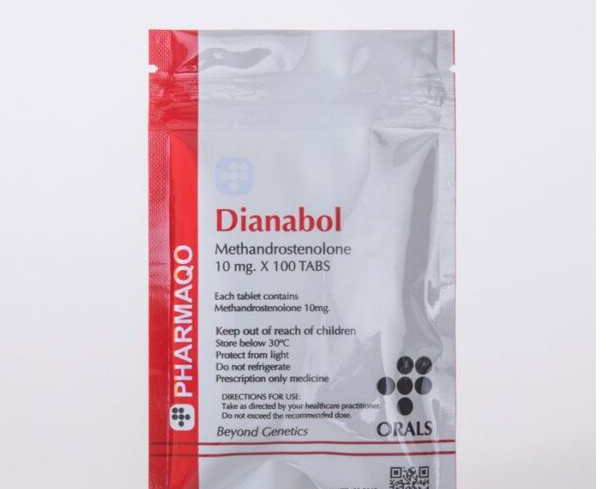

A gold ira rollover can be a procedure in which you exchange your retirement money coming from a standard 401(k) or IRA bank account right into a self-guided person retirement life account (IRA) that invests in precious materials like gold, gold, platinum, and so on., rather than typical expense possibilities. The Internal Revenue Service permits you to do that without incurring any taxes penalties, as long as you stick to specific polices.

Why Think about a Gold ira rollover?

Buying gold gives a feeling of protection that other ventures deficiency. Unlike paper currency, precious metal has intrinsic worth and has been used as a type of currency and transaction for many years. With monetary anxiety looming, central financial institutions stamping more income, and ever-expanding financial debt, golden delivers balance and diversity with your pension profile. In addition, as opposed to currency, golden rates can raise during unclear monetary periods, so that it is a beautiful and profitable long term expense option.

How to do a Gold ira rollover?

Imagine you’re considering acquiring your retirement with treasured metals. In that case, step one entails choosing a reputable golden IRA custodian. Make sure that the custodian is skilled with changing classic IRA profiles into precious aluminum IRAs and it is well-versed in IRS polices. After you’ve discovered the custodian, they’ll allow you to create a new self-directed IRA profile and exchange your existing IRA resources on the new account. You’ll then utilize these resources to buy the precious alloys of your choosing.

Facts to consider prior to a Gold ira rollover

Well before choosing a Gold ira rollover, you should think about your expenditure goals, chance threshold, and financial predicament. Even though making an investment in precious metals can be rewarding, it’s not really a assure, and costs can fluctuate. You need to take into account that making an investment in rare metal is not going to provide any income, and you’ll have to rely on promoting the resource for profit later on. It’s always best to consult with a economic advisor prior to making any substantial expenditure selections.

Simply speaking:

In Simply speaking, a Gold ira rollover supplies a secure and profitable way to invest in valuable precious metals although obtaining your retirement living savings. With ever-improving economic anxiety and rising cost of living, precious metal offers a stable expense alternative that can diversify your collection and supply a stable way to obtain worth. Make sure to look at your financial situation, expenditure objectives, and meet with a skilled before you make expenditure selections. Purchasing precious metal could be a useful and successful expertise if done efficiently.